“Thank you, sir, we will go ahead & initiate the process of getting the repairs done, we will handle all of this & will get you your vehicle in a week, nothing for you to worry about 😊” The insurance rep dons the customer friendly smile and confirms this.

“Great, thanks. What about my transport during this time & my medical bills?”.

“Sorry sir, those are not available under this policy. Post this you can buy these with us, let me get you a quote”.

“WHAT??!!!!”

What does Insurance mean to the customers? Financial indemnification or beyond as in Emotional Security & Peace of Mind – the feeling that we are in safe hands, come what may, and that we are always taken care of?

Do Insurance Companies, through their Products address this dimension? Our topic of the day!

In a move towards going beyond the traditional “Inside-Out”, Insurance companies have started exploring new models, in terms of offerings – pay as you use/go, embedded insurance, etc. It’s great, but the question is: Is that all? Is that sufficient?

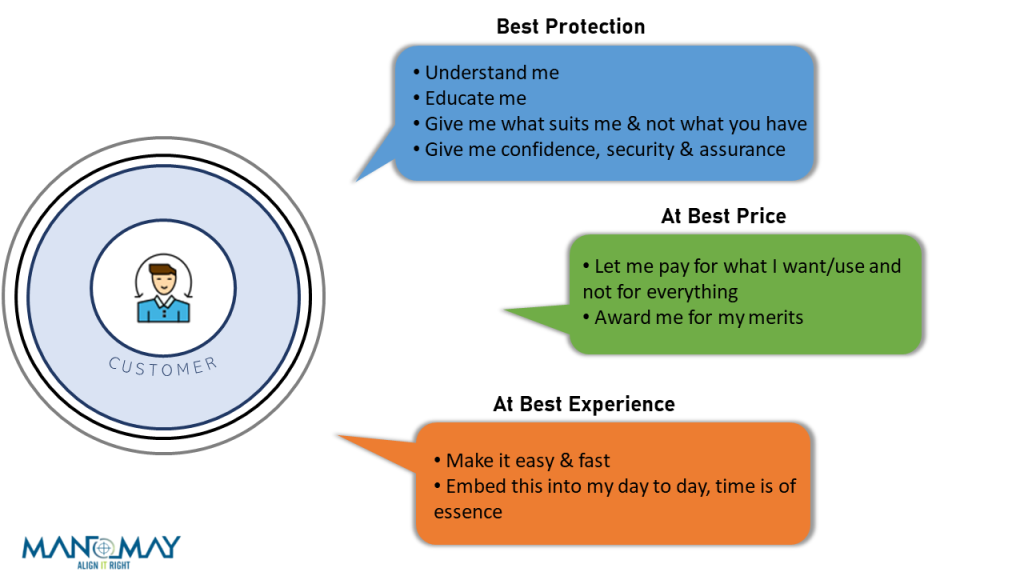

Let’s look at some of the questions that the Customers are asking. Maybe a good start to finding out answers –

- Why can’t I get protected for accident injuries under my car policy? When I am in an accident, I can’t think of myself and my car separately.

- My important items will only be exposed to risk at certain times, can I get insurance only for that time?

- I started my job, got a new car, got married & my wife & I am planning to start a family – all this happened in a year – I want to be protected if I lose my job (I am Software Engineer), I want to protect my family (If something were to happen to me) and I want all our assets to be protected (just from Catastrophes, for we live in Islands…) – I just want to have all-in-one protection.

- I have my pet always with me when I travel. How do I protect it?

- I am a young driver, but a responsible one, why do I have to pay more premium? Is it wrong to be young? 🙁

- I do not need half the coverages listed here, is there a way where I do not have to pay for these?

- …on goes the list

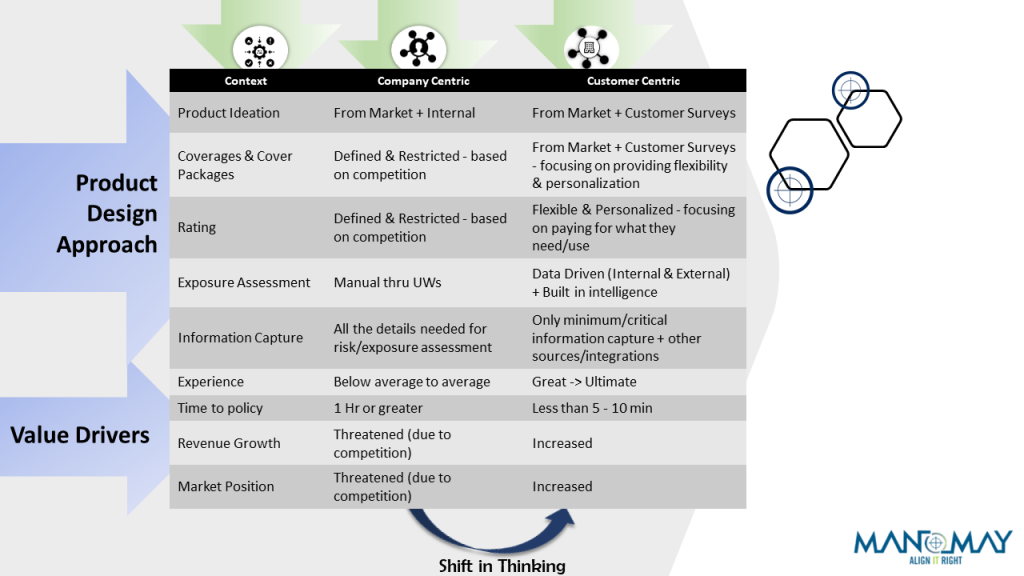

Addressing ‘Today’s’ customer needs, warrants a shift in thinking from ‘Inside – out’ to ‘Outside – in’. A quick sneak – peek into the recommended ‘Inclusive’ product design thinking approach – right from ideation to definition.

For coming up with THAT right product design & its manifestation, the key requisites/guiding criteria to be considered are,

- Inclusive thinking in the E2E journey (productization to servicing) – embedding insurance into their day-to-day

- Understanding the customer profile and providing the best suitable recommendations

- Embedding Flexibility & Personalization into every aspect of the design – products, coverages, rating, information capture, and overall experience, etc.

- Ensuring collection of bare minimum information captured thru intuitive & interactive UI – experience is of pivotal importance

- Being Data rich – Internal (/Historical data) & bringing in data through Integrations (government, market, and other context-specific databases)

- Intelligence built by leveraging new gen technology for E2E manifestation – especially AI, ML & DL etc.

To service your customers better, to beat the competition, and to be the one in the market – customer-centric thinking needs to be embedded in the DNA of the company, and it is beyond provisioning self-service portals.

It’s not about what you have – it’s about what they WANT!

As with any other change, this is a journey of maturity. Reach out to us @inquisite@manomay.biz or @biztechinsights@manomay.biz to know more.

Biz Tech Insights Team Manomay

Disclaimer: The views and findings expressed in this material are for informational and educational purposes only. It is not intended as a guideline, recommendation, or substitute for any form of Professional (Consulting or Technology) advice. Under no circumstance shall we bear legal responsibility for the use or reliance of any information mentioned in this article. Unless otherwise specified, the views, case studies, and findings expressed herein are our own. The content displayed here is the Intellectual Property of Manomay Consultancy Services (India) Pvt Ltd. You may not reuse, republish or reprint any of the aforementioned content without our written consent.

Sign up for our newsletters!